Tuesday May 21, 2019

By Paul Barach

News

News

For cannabis consumers of a certain generation, “BC Bud” used to mean something. Back in the days before any US states had legalized (AKA The Bad Times, The Before Before, or The Long Long Ago), getting your cannabis from Canada was as good a bet for quality as getting it from Northern California. However, the latest word coming out of post-legalization Canada is that their pot quality has been dropping significantly, or that it was never there in the first place. Word around the campfire is that Canadian flower from some of their major producers is dry, harsh, and even mildewy or moldy.

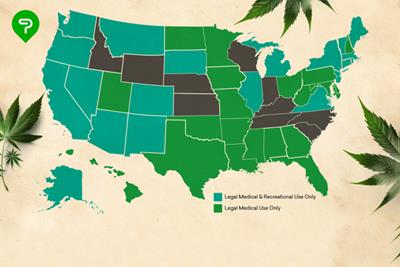

This is disappointing, since all eyes are on the first G7 country to legalize cannabis on a federal level. What’s more, Canada is currently on track to become the largest exporter of cannabis in the world, with countries like Israel and the Netherlands still lagging behind. So, what is going on with our neighbor to the North? Is the pressure getting too much? Did they bite off more than they could chew where weed is concerned?

A Closer Look at Canada’s Cannabis Quality

When taking a closer look at some consumer feedback, there are an alarming amount of negative reviews circulating the Internet that point out poor quality. Going by some Google reviews at Ontario’s Hunny Pot Cannabis Co., the answer would appear to be yes. The shop itself is at a dismal 2.7 stars, with strain reviews such as:

- “Overpriced and terrible quality. The product Hunny Pot is selling is dry, brittle and stale.”

- “I picked up some of the ‘City Lights’ strain, looks incredible, gives a pretty mediocre high. And this strain, in my opinion was one of the better they offered.”

- “The weed is pretty dry, and not that great. The $3g weed I get "elsewhere" is much better than the $17 gram I bought here.”

Canadians on the subreddit r/RecPics are reporting similar issues, with one poster reporting “I just got some bud from Tantalus and Canna Farms... supposedly 2 of the more "premium" brands, and was horrified to find they were from September and October 2018. You could squeeze them and they'd turn to dust.” Another commentator had similar complaints, stating “I just bought this...Weighed out at 3.4g. It's so dry and brittle it crumbles to the touch. The only smell is of faint chemical, which I'm pretty sure is just the plastic container...I figured I would do my part here and try the legal side of things. With these prices and quality, I won't be back. Not until something changes.”

Ontario seems to be the epicenter of this low-quality weed problem. Local cannabis producer RedeCan had to ask customers to return any weed purchased from them in exchange for a full refund after multiple complaints of mold found in their product several months after the commencement of recreational sales. The problem is not limited to just one producer, either. Ontario’s local government is also dropping the ball on their cannabis supply, with the Ontario Cannabis Store (OCS) being blamed for providing weak weed, losing orders, and plenty of other issues that are driving customers back to illegal stores.

Although Ontario is certainly the worst offender so far (at least from what’s been reported by the media and public), the sentiment regarding how much un-dank weed is in circulation appears to be spreading all over Canada. In the Canadian stock market, share prices for both major and minor producers are taking a hit.

Is Low-Quality Cannabis Affecting Canadian Marijuana Stocks?

To take one example, cannabis producer Tilray - which reported $43 million in sales last year – is failing to keep up with demand and it’s not a secret. CEO Brian Kennedy has admitted to investors over conference call that it’s hard to find quality weed and that they’ve had to search elsewhere for a sufficient supply. Aurora, Canopy, Cronos, and Hexo all closed with their stock prices down recently on the Canadian stock exchange.

According to market analyst Vivien Azer, from the investment banking company Cowen, the two big culprits for this cannabis downturn are supply problems and sub-standard quality weed.

Essentially, Canada’s problem is that the supply is still far below the demand and producers are pushing out poor product because they haven’t mastered the production stream. Without enough quality weed being grown and supply shortages frustrating consumers nationwide, everything must go out to the shelves whether it’s show ready or not. One can only speculate what this means for the future of Canada’s great legalization experiment. Will it be a cautionary tale, like the time McDonalds introduced the McPizza into Canada? Or is there still a chance for success, like the time Pizza Hut introduced the Poutine Pizza into Canada?

Canada will clearly need to step up their production game. They’ll also have to work harder to win back their customers who are still going, as that one reviewer said, “elsewhere” for their weed. In the short term, it’s not going to be enough. As of now, market analysts are predicting that Canada’s weed revenue will drop in the second half of 2019. However, investors are not dropping out yet. Canada remains the only G7 national to have federally legalized and a true competitor for the predicted $130 billion global cannabis market (by 2029) has yet to emerge.

Don’t Count Out Legal Cannabis Just Yet

If you’re worried about the quality of Canada’s cannabis having any impact on the tenure of legalization in the Great White North, you have nothing to fear. After all, it’s not as though Canada’s citizens are going to give up legalization after a year or two of sub-standard weed. The benefits of repealing cannabis prohibition are too obvious to ignore. Nearly everyone predicted that Canada would face some hurdles before full federal legalization was running smoothly. The latest hurdles are some crumbly, weak, moldy weed. That can all be improved upon – plus, consumers have edibles and concentrates to look forward to in the near future.

Vivien Azer expects these momentary supply issues to be resolved. She is predicting sales for Canopy alone ”jumping from C$239 million in fiscal 2019 to C$778 million in fiscal 2020, a 225 percent rally.” Analysts from companies like Arcview Market Research and BDS Analytics are similarly optimistic. In a new report, they predict that Canada’s cannabis market could reach $5.2 Billion CAD domestically by 2024, with adult use sales at $4.8 billion.

In the meantime, Canada’s marijuana consuming citizens are going to have to sit tight, especially in Ontario. While this isn’t ideal, it’s hard to imagine an entire nation deciding to create an entirely new market for a previously illegal substance and having it go smoothly from beginning to end. Most Canadians are still focusing on the big picture: weed is legal in Canada. It’s a pretty huge deal.

Have you tried any legal cannabis in Canada? What was your experience like? Share your thoughts in the comments below!

Photo Credit: Get Budding (license)